.

When it comes to buying or selling a home, there are several key players involved in the process. Two of these players are title companies and escrow services. Both are involved in administering real estate transactions, but what exactly do they do, and how do they differ from each other? In this blog, we’ll dive into the details of escrow vs title, exploring what each one does, and when you might need to use them during your home buying or selling journey. Understanding the differences between these two services can help you make informed decisions and navigate the real estate process with confidence.

Understanding the Role of an Escrow Company

If you’re buying or selling a home, you might be wondering what the difference is between an escrow company and a title company. Both types of companies play an important role in the real estate transaction process, but they offer different and sometimes overlapping services. Here’s a look at the differences between escrow and title companies, and what each one can do for you.

What is an Escrow Company?

An Escrow Company is a financial service provider that facilitates the completion of an online transaction. It serves as a neutral third-party that holds funds on behalf of two parties, until all conditions of the contract are satisfied and fulfilled. Escrow Companies provide security to both parties in a transaction by verifying that all required payments and documents have been received.

The escrow process in real estate is helps to ensure that all parties fulfill their obligations as outlined in the legal agreements and are satisfied by the closing date.

The best example of escrow is when a homebuyer finds and puts an offer in on a home that is listed for sale. The buyer is asking the seller to not market or sell that home to someone else for the 45-60 days it will take the buyer to secure loan financing. The seller agrees to these terms in exchange for an agreed deposit amount that will sit in the escrow account with the escrow company, let’s say the amount is $5,000.

If the buyer defaults and does not apply for a mortgage by the dates in the contract, the escrow agent will release the $5,000 escrow check to the seller, to cover the cost of not selling the house to someone else during the 45-60 days. If the buyer does not default, the $5,000 deposit will be applied to the amount of funds needed to close on settlement day.

Description of Services Provided by an Escrow Company

An escrow company is an invaluable partner when it comes to buying and selling a home. It holds all funds in a secure account until all the conditions of the sale have been met, ensuring that both parties are satisfied before any money is transferred. An escrow company acts as a neutral third-party during the real estate transaction process

The Importance of a Title Company in Real Estate

A title company provides crucial services during the home-buying and selling process. They are responsible for verifying that a seller owns the property they are selling, as well as making sure no other claims exist on the property. To do this, they research public records of the property’s title to ensure its accuracy and completeness. Title companies also prepare loan documents sent by the bank and ensure all documents are signed and executed correctly. Lastly, at the end of the closing and signing of all documents, the title company and title agent will balance and disburse checks to all parties that are due and invoiced.

Services Provided by a Title Company

A title company plays an important role in the real estate transaction process. They are responsible for researching and verifying the validity of a property’s ownership, ensuring that all parties involved have clear and legal title to the land or home. Title companies also assist in insuring that any liens on the property are identified and paid off before closing. Additionally.

Benefits & Drawbacks of Using an Escrow Company & Title Company

When you’re buying or selling a home, you’ll likely come across the terms “escrow company” and “title company.” Knowing the difference between an escrow company and title company is important when you are buying or selling a home. A title company is responsible for confirming ownership of the property by researching title records. An escrow company acts as a holder of funds during the closing process, making sure that all conditions of sale – financial and otherwise – are satisfied before releasing any money to the seller. Whether you’re a buyer or seller, choosing a reputable title/escrow company to help guide you through the intricate process of real estate transactions is critical to protecting your interests in this major life decision.

Do You Need Both an Escrow and Title Company?

When it comes to buying or selling a home, escrow, and title companies play an important role in the process. An escrow company ensures the seamless exchange of documents between all parties involved–the escrow agent acts as a third-party buffer between buyers, sellers, and real estate agents, ensuring loan documents are collected properly and all other contractual agreements are met. Title companies provide a comprehensive search of the property’s title–verifying ownership rights and any possible liens that may affect the purchase. Although escrow and title services are different, both are required when purchasing or selling a home, making them indispensable services for both buyers and sellers in real estate transactions.

Comparing Escrow and Title Services: A Closer Look

Buying or selling a home can be an overwhelming process, so it’s important for homebuyers and home sellers to have a thorough understanding of what escrow companies and title companies do. Escrow services manage the home purchase process between buyers and sellers, handling all documents and funds related to the home sale. An escrow account is opened during the home purchase process and holds all of the money owed until both parties fulfill their contractual obligations. On the other hand, a title company ensures that all legal claims on a property have been addressed prior to closing on the home by issuing title insurance policies. Therefore, understanding the difference between these two

If we want to throw another term in the mix, there are also states that still use a “closing attorney” to assist buyers and sellers when buying and selling homes, in place of an escrow company or title company.

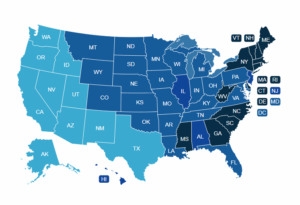

Title companies and escrow companies each provide individual services that are necessary when you’re buying or selling a home. A title company is responsible for researching whether there are any current property claims or restrictions on the home you’re purchasing. An escrow company helps manage money that’s exchanged during your real estate purchase and ensures all the necessary documents are filed correctly. Both of these services are essential steps in successful real estate transactions and should be taken into consideration when making your purchase. Depending on what state you live in, both escrow companies and title companies can offer additional services to help streamline the process of buying or selling a home. To learn more about these services, check out our list of states below to determine which services you require. Alternatively, speak with your local realtor so they can provide more information about what is included in the purchase process for your area.

You can find more information about when you need an escrow company, title company, and attorney present by referencing the resources outlined below:

-

- Sandy Gadow has a very detailed state-by-state guide that was extremely helpful in cross-checking the information above.

- First American Title has an overview of the home-buying process for all 50 states, which provided a good starting point indicating which states follow which process.

When it comes to administering a real estate transaction, title and escrow services are two options to consider. While a title company can serve as a one-stop solution, not all states recognize this process, and some still require a licensed attorney to handle contracts and closings. In such cases, an escrow service may be used for those portions of the transaction that the attorney doesn’t handle. Regardless, you will need to consult a title agent to obtain title insurance for yourself and your mortgage lender.

Your Realtor can guide you in deciding whether to use a title company or an escrow service. While prices and fees for title companies are generally regulated, it’s important to consider closing costs and escrow amounts for taxes and insurance.

Pre-paid closing costs include property taxes and insurance, and the escrow fees required to fund this account are determined by the mortgage lender, not the title company or escrow service. As the home buyer, you are responsible for funding this account, so make sure you understand the amounts and purpose of the account.